Does new economic data show that austerity does not work?

+22

James Gibson

skwalker1964

Redflag

Tosh

boatlady

Bernadette

astradt1

betty.noire

blueturando

tlttf

Adele Carlyon

Phil Hornby

Red Cat Woman

witchfinder

bobby

Ivan

astra

trevorw2539

oftenwrong

sickchip

Mel

Stox 16

26 posters

:: The Heavy Stuff :: UK Economics

Page 8 of 10

Page 8 of 10 •  1, 2, 3, 4, 5, 6, 7, 8, 9, 10

1, 2, 3, 4, 5, 6, 7, 8, 9, 10

Does new economic data show that austerity does not work?

Does new economic data show that austerity does not work?

First topic message reminder :

Adding in new economic data shows that the so-called Austerity economic policy alone does not work. It's clear too me that its totally unsustainable as it destroys countries competiveness while draining confidence within business while driving down not only living standers that in turn shrinks demand. Do you believe the Tories will stick with there only economic policy up-to the next GE? if they do, I happen to believe most people will call time on the Tory party.

Growth Forecast downgraded for the Fifth time by (OBR in November 2011

Growth forecast Downgraded for 2nd Time by Bank of England 1.4% August 2011

Growth forecast Downgraded for 3rd Time to 1.7% (Budget 2011)

Growth forecast Downgraded for 3rd Time to by Ernst & Young from1.7% to 0.9% Jan 2012

Growth forecast Downgraded for 2nd Time to by CBI to 1.3% July 2011

Growth forecast Downgraded for 4th Time to by CBI to 1.2% Sept 2011

Growth forecast Downgraded for 4th Time to by CBI to 0.9% Feb 2012

Growth forecast Downgraded for 3rd Time to by I.M.F to 1.3% July 2011

Growth forecast Downgraded for 4th Time to by I.M.F to 0.6% Jan 2012

Growth forecast in the Tory budget down for a 3rd time to 1.7% (Budget 2011

Growth forecast in the City as low as 1.2% 2011

Disposable income has seen its Sharpest fall in 30 years or 1980s (ONS)

Annual Earnings Growth remains at 1.9% in February 2012

GDP The last cycle of robust growth in potential output of 2.9% was 1997 to 2006 (OBR & Oxford Economic)

GDP when the Tory-Liberal coalition come to power ,the UK was growing at an annual rate of 4% (OBR)

GDP sluggish at just 0.5% for April 2011 (OBR)

GDP City Growth forecast for 2012 are 0.3% to 0.4% (FT Sept 2011)

GDP Growth for forecast set by bank of England at 2.0% 2010

GDP Contracted by 0.5% in the Q4 in 2010 (OBR)

GDP is 0.8% lower than in November 2010 (OBR)

GDP IS 0.2% lower than MARCH 2011 (OBR)

GDP Growth Contracted by 0.5% Q4 2010 (OBR)

GDP Growth April 2011 was Q1 0.5% (OBR)

GDP Growth July 2011 was just Q2 0.2% (OBR)

GDP Growth starts Jan Q1 2012 at just 0.2% (OBR)

GDP Growth December 2011 Contracted by 0.2% Q4 (OBR)

GDP April's figures have just clawed back last years 0.5% contraction in 2010 (OBR)

GDP is 1.1% lower than the OBR thought it would be in Sept 2010 (OBR)

GDP Growth is now lower than 1930s, 1970s, 1980s 1990s (OBR)

GDP UK is 3.6% blow its pre-financial crisis 2008 (H.M.Trasury)

National Debt hits £1.03 Trillion for the first Time Jan 2012 (OBR)

National Debt actual debt after repurchase by Bank of England is £650 Billion (Guardian on B of E figures)

National Debt Coalition & Bank of England QE for 2011 was £75 billion (OBR/Bank of England)

National Debt Coalition & Bank of England QE for 2012 was £50 billion (OBR/Bank of England)

National Debt total Quantitative Easing is £325 Billion in February 2012 (OBR/Bank of England)

National Debt private + public sector debt totals some 500% 2011 (OBR & Oxford Economic)

National Debt Tory Party forecast National debt will fall by just £54 Billion by 2015 (Tory party website)

UK Economic Decline is two and half times that of the entire Euro zone (ONS & H.M.Trasury) 2011

UK Economic Decline is 77% of the EU’s decline for 2011 (H.M.Trasury)

UK Economy shrank by 5.0% in 2009 the biggest calendar year fall since 1921 ( NIE)

UK Economy shrank by 6.3% in 2011 the biggest calendar year fall on record by October 2011 ( NIE)

UK Pound exchange rate has fallen by 21.0% against the Dollar 2011 (H.M.Trasury)

UK lose market share accelerated from 2008 to 2010. (Oxford Economic )

Government Borrowing Tory-Liberal coalition come to power stated an additional £111 Billion 2009 (OBR)

Government Borrowing Net borrowing was just £7.3 Billion in 2010 (H.M.Trasury)

Government Borrowing forecast up by £54 Billion (Budget 2011)

Government Borrowing overshot in Q4 by £127 Billion (OBR)

Government Borrowing overshot in Jan 2012 by £157 Billion (ONS)

Government Borrowing topped the £10 billion by just Feb 2011 (OBR)

Government Borrowing to be £10 billion higher every year from 2012 (OBR)

Government Borrowing in Jan 2012 was £13.7 billion for December 2011 overshooting (OBR)

Private Pension deficit up from £24.5 Billion to £31.7 Billion by Sept 2011 (ONS)

Private Pension Deficit £158 billion December 2011 (ONS)

Private Pension deficit £255.2 form £222 billion in Jan 2012 (N.M.A & ONS)

UK 10 Year bonds, the Historical high of 12.84% set in April 1990 (H.M.Trasury)

UK 10 year Bonds, Record low of 1.97% set in Jan 2012 (H.M.Trasury)

UK 10 Year Bonds, Yields decline by 1.47% from 1989 to 2012 (H.M.Trasury)

UK 10 Year Bonds, averaged 6.28% (H.M.Trasury)

Unemployment up to record 17 year high (ONS)

Unemployment record was set in 1981 at 2.6 million or 9.8% of the Workforce

Unemployment for woman rose for the 10th month in a row March 2011 (ONS)

Unemployment increased by 20,000 the highest three month figure since Jan 1997 (ONS)

Unemployment is now 7.7% of economically active population March 2011 (ONS)

Unemployment forecast in the budget set to rise to 8.1% in 2012 (Budget 2011)

Unemployment is was2.6 million in March 2011 (ONS)

Unemployment is now 2.8 million in December 2011 (ONS)

Unemployment Claimants increased by 12,400 in March 2011 to April 2011 (ONS)

Unemployment Woman Claimants increased by 9,300 to 474,400 in March 2011 (ONS)

Unemployment Men Claimants increased by 3,100 to 994,200 in March 2011 (ONS)

Unemployment 16-24 hit 1.043 million in Q3, the highest since records began in 1992. 2011 (ONS)

Unemployment benefit payments rose by 1,200 to 1.6 million by December 2012 (ONS)

Unemployment benefit payments up to 1980s levels (ONS)

Business failures in 2010 was 23,000 (ONS)

Business failures in 2011 was 20,900 or 6.5% (ONS)

Bankers Bonus for £14 billion for 2011 (FT & Guardian & BBC)

Manufacturing was flat Feb 2011 (ONS)

Manufacturing production out put 1.5% decline in April 2011 (ONS)

Manufacturing touted as the engine of the economy fall by 0.3% in July 2011 (ONS)

Manufacturing jobless in Q4 2011 to Jan 2012 was up to 395,000

Manufacturing production Cable & Wireless Communication slumped nearly 17% in 2011 (FT)

BDOs output index dropped from Decembers 91.4% to February 2012 to 91.2%

Exports fell in Jan 2011 (HMCR)

Exports Vs Imports increased by 14.7% in October 2011 (HMCR)

Factory gate prices rose 0.9% between February & March 2011 (ONS)

Factory gate prices rose at an annual rate of 5.3% in May 2011 (ONS)

Factory gate prices in December 2011 to 4.8% (ONS)

Factory gate prices fell in January 2012 to 4.1% (ONS)

Factory gate Producers input price inflation in January 2012 is 7% (ONS)

Mortgage & Credit card debt will soar to £2,126 billion by 2015 (ONS)

Mortgage debt now accounts is around £21,000 per person April 2011 (ONS)

Home repossessions peak set in 1991 at 19,000 homes (council of mortgage lenders)

Home repossession forecast to rise to 45,000 in 2012 (council of mortgage lenders )

Construction industry suffered a 0.5% fall in output from November to January 2012 (ONS)

North sea Oil Tax up by £2 Billion for 2011, with HMCR taking 88% in Tax (ONS)

The Worst squeeze on living standards for 90 years

Consumer spending accounts for 65% of the UK economy April 2011 (OMS)

Consumer spending shows the biggest fell in total sales since the survey began in 1995 (KPMG)

Consumer spending has fallen by 1.7% for four consecutive Q in 2011. (ONS)

Personal Spending shows it first drop in personal spending power since the Thatcher slump in 1980s (KMPG)

Petrol down by 1p with VAT up by 2% in the Budget 2011

Petrol prices average increased by 52% up to March 2010

Food Prices rose 7.4% in the biggest rise since 2009 (ONS)

Food Prices rising at 4.9% rising faster than any other OECD in Jan 2012 member (UBS & OECD)

CPI Inflation increase to 3.3% December 2010 (OBR & Oxford Economic)

CPI has put the cost of living double its target from 4% in Jan 2011 to 4.4% in April 2011 (OBR & Oxford Economic)

CPI September 2011 rises by 5.2% (ONS)

CPI October 2011 fall by just 0.2% to 5.0% (ONS)

CPI January 2012 fell to 4.8% from 5.0% (Bank of England)

RPI has gone from 5.1% to 5.5% the highest since 1991 (ONS)

RPI Jan 2011 leapt to CPI 4% from 3.7% with Market Oracle putting real inflation at 6.6% 2012 .

Adding in new economic data shows that the so-called Austerity economic policy alone does not work. It's clear too me that its totally unsustainable as it destroys countries competiveness while draining confidence within business while driving down not only living standers that in turn shrinks demand. Do you believe the Tories will stick with there only economic policy up-to the next GE? if they do, I happen to believe most people will call time on the Tory party.

Growth Forecast downgraded for the Fifth time by (OBR in November 2011

Growth forecast Downgraded for 2nd Time by Bank of England 1.4% August 2011

Growth forecast Downgraded for 3rd Time to 1.7% (Budget 2011)

Growth forecast Downgraded for 3rd Time to by Ernst & Young from1.7% to 0.9% Jan 2012

Growth forecast Downgraded for 2nd Time to by CBI to 1.3% July 2011

Growth forecast Downgraded for 4th Time to by CBI to 1.2% Sept 2011

Growth forecast Downgraded for 4th Time to by CBI to 0.9% Feb 2012

Growth forecast Downgraded for 3rd Time to by I.M.F to 1.3% July 2011

Growth forecast Downgraded for 4th Time to by I.M.F to 0.6% Jan 2012

Growth forecast in the Tory budget down for a 3rd time to 1.7% (Budget 2011

Growth forecast in the City as low as 1.2% 2011

Disposable income has seen its Sharpest fall in 30 years or 1980s (ONS)

Annual Earnings Growth remains at 1.9% in February 2012

GDP The last cycle of robust growth in potential output of 2.9% was 1997 to 2006 (OBR & Oxford Economic)

GDP when the Tory-Liberal coalition come to power ,the UK was growing at an annual rate of 4% (OBR)

GDP sluggish at just 0.5% for April 2011 (OBR)

GDP City Growth forecast for 2012 are 0.3% to 0.4% (FT Sept 2011)

GDP Growth for forecast set by bank of England at 2.0% 2010

GDP Contracted by 0.5% in the Q4 in 2010 (OBR)

GDP is 0.8% lower than in November 2010 (OBR)

GDP IS 0.2% lower than MARCH 2011 (OBR)

GDP Growth Contracted by 0.5% Q4 2010 (OBR)

GDP Growth April 2011 was Q1 0.5% (OBR)

GDP Growth July 2011 was just Q2 0.2% (OBR)

GDP Growth starts Jan Q1 2012 at just 0.2% (OBR)

GDP Growth December 2011 Contracted by 0.2% Q4 (OBR)

GDP April's figures have just clawed back last years 0.5% contraction in 2010 (OBR)

GDP is 1.1% lower than the OBR thought it would be in Sept 2010 (OBR)

GDP Growth is now lower than 1930s, 1970s, 1980s 1990s (OBR)

GDP UK is 3.6% blow its pre-financial crisis 2008 (H.M.Trasury)

National Debt hits £1.03 Trillion for the first Time Jan 2012 (OBR)

National Debt actual debt after repurchase by Bank of England is £650 Billion (Guardian on B of E figures)

National Debt Coalition & Bank of England QE for 2011 was £75 billion (OBR/Bank of England)

National Debt Coalition & Bank of England QE for 2012 was £50 billion (OBR/Bank of England)

National Debt total Quantitative Easing is £325 Billion in February 2012 (OBR/Bank of England)

National Debt private + public sector debt totals some 500% 2011 (OBR & Oxford Economic)

National Debt Tory Party forecast National debt will fall by just £54 Billion by 2015 (Tory party website)

UK Economic Decline is two and half times that of the entire Euro zone (ONS & H.M.Trasury) 2011

UK Economic Decline is 77% of the EU’s decline for 2011 (H.M.Trasury)

UK Economy shrank by 5.0% in 2009 the biggest calendar year fall since 1921 ( NIE)

UK Economy shrank by 6.3% in 2011 the biggest calendar year fall on record by October 2011 ( NIE)

UK Pound exchange rate has fallen by 21.0% against the Dollar 2011 (H.M.Trasury)

UK lose market share accelerated from 2008 to 2010. (Oxford Economic )

Government Borrowing Tory-Liberal coalition come to power stated an additional £111 Billion 2009 (OBR)

Government Borrowing Net borrowing was just £7.3 Billion in 2010 (H.M.Trasury)

Government Borrowing forecast up by £54 Billion (Budget 2011)

Government Borrowing overshot in Q4 by £127 Billion (OBR)

Government Borrowing overshot in Jan 2012 by £157 Billion (ONS)

Government Borrowing topped the £10 billion by just Feb 2011 (OBR)

Government Borrowing to be £10 billion higher every year from 2012 (OBR)

Government Borrowing in Jan 2012 was £13.7 billion for December 2011 overshooting (OBR)

Private Pension deficit up from £24.5 Billion to £31.7 Billion by Sept 2011 (ONS)

Private Pension Deficit £158 billion December 2011 (ONS)

Private Pension deficit £255.2 form £222 billion in Jan 2012 (N.M.A & ONS)

UK 10 Year bonds, the Historical high of 12.84% set in April 1990 (H.M.Trasury)

UK 10 year Bonds, Record low of 1.97% set in Jan 2012 (H.M.Trasury)

UK 10 Year Bonds, Yields decline by 1.47% from 1989 to 2012 (H.M.Trasury)

UK 10 Year Bonds, averaged 6.28% (H.M.Trasury)

Unemployment up to record 17 year high (ONS)

Unemployment record was set in 1981 at 2.6 million or 9.8% of the Workforce

Unemployment for woman rose for the 10th month in a row March 2011 (ONS)

Unemployment increased by 20,000 the highest three month figure since Jan 1997 (ONS)

Unemployment is now 7.7% of economically active population March 2011 (ONS)

Unemployment forecast in the budget set to rise to 8.1% in 2012 (Budget 2011)

Unemployment is was2.6 million in March 2011 (ONS)

Unemployment is now 2.8 million in December 2011 (ONS)

Unemployment Claimants increased by 12,400 in March 2011 to April 2011 (ONS)

Unemployment Woman Claimants increased by 9,300 to 474,400 in March 2011 (ONS)

Unemployment Men Claimants increased by 3,100 to 994,200 in March 2011 (ONS)

Unemployment 16-24 hit 1.043 million in Q3, the highest since records began in 1992. 2011 (ONS)

Unemployment benefit payments rose by 1,200 to 1.6 million by December 2012 (ONS)

Unemployment benefit payments up to 1980s levels (ONS)

Business failures in 2010 was 23,000 (ONS)

Business failures in 2011 was 20,900 or 6.5% (ONS)

Bankers Bonus for £14 billion for 2011 (FT & Guardian & BBC)

Manufacturing was flat Feb 2011 (ONS)

Manufacturing production out put 1.5% decline in April 2011 (ONS)

Manufacturing touted as the engine of the economy fall by 0.3% in July 2011 (ONS)

Manufacturing jobless in Q4 2011 to Jan 2012 was up to 395,000

Manufacturing production Cable & Wireless Communication slumped nearly 17% in 2011 (FT)

BDOs output index dropped from Decembers 91.4% to February 2012 to 91.2%

Exports fell in Jan 2011 (HMCR)

Exports Vs Imports increased by 14.7% in October 2011 (HMCR)

Factory gate prices rose 0.9% between February & March 2011 (ONS)

Factory gate prices rose at an annual rate of 5.3% in May 2011 (ONS)

Factory gate prices in December 2011 to 4.8% (ONS)

Factory gate prices fell in January 2012 to 4.1% (ONS)

Factory gate Producers input price inflation in January 2012 is 7% (ONS)

Mortgage & Credit card debt will soar to £2,126 billion by 2015 (ONS)

Mortgage debt now accounts is around £21,000 per person April 2011 (ONS)

Home repossessions peak set in 1991 at 19,000 homes (council of mortgage lenders)

Home repossession forecast to rise to 45,000 in 2012 (council of mortgage lenders )

Construction industry suffered a 0.5% fall in output from November to January 2012 (ONS)

North sea Oil Tax up by £2 Billion for 2011, with HMCR taking 88% in Tax (ONS)

The Worst squeeze on living standards for 90 years

Consumer spending accounts for 65% of the UK economy April 2011 (OMS)

Consumer spending shows the biggest fell in total sales since the survey began in 1995 (KPMG)

Consumer spending has fallen by 1.7% for four consecutive Q in 2011. (ONS)

Personal Spending shows it first drop in personal spending power since the Thatcher slump in 1980s (KMPG)

Petrol down by 1p with VAT up by 2% in the Budget 2011

Petrol prices average increased by 52% up to March 2010

Food Prices rose 7.4% in the biggest rise since 2009 (ONS)

Food Prices rising at 4.9% rising faster than any other OECD in Jan 2012 member (UBS & OECD)

CPI Inflation increase to 3.3% December 2010 (OBR & Oxford Economic)

CPI has put the cost of living double its target from 4% in Jan 2011 to 4.4% in April 2011 (OBR & Oxford Economic)

CPI September 2011 rises by 5.2% (ONS)

CPI October 2011 fall by just 0.2% to 5.0% (ONS)

CPI January 2012 fell to 4.8% from 5.0% (Bank of England)

RPI has gone from 5.1% to 5.5% the highest since 1991 (ONS)

RPI Jan 2011 leapt to CPI 4% from 3.7% with Market Oracle putting real inflation at 6.6% 2012 .

Stox 16- Posts : 1064

Join date : 2011-12-18

Age : 65

Location : Suffolk in the UK

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

It was helpful of Gideon to explain that there are likely to be six more years of austerity measures. That totals TEN stagnant years following the Credit Crunch of 2008. Anybody remember that? We voted for a change of government to put things right. (Well, I didn't but somebody musta.)

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Unemployment falls

Unemployment falls

The country's jobless total fell by 82,000 in the three months to October, leaving 2.51million people looking for work - an unemployment rate of 7.8 per cent

29.6 million Britons now have a job - the highest number in history

This is good news for the country and it was also nice to see Ed Miliband welcoming the news in PMQs this morning.

Perhaps the coalition have the right economic plan afterall!!

29.6 million Britons now have a job - the highest number in history

This is good news for the country and it was also nice to see Ed Miliband welcoming the news in PMQs this morning.

Perhaps the coalition have the right economic plan afterall!!

blueturando- Banned

- Posts : 1203

Join date : 2011-11-21

Age : 57

Location : Jersey CI

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

blueturando. Good to see that you haven’t lost your sense of humour! Or is that remark, based on one very misleading set of figures, just a sign of someone clutching at straws in a feeble attempt to defend the disastrous policies of this government?Perhaps the coalition have the right economic plan afterall!!

John Cassidy has explained how “right” Osborne’s economic plan is:-

"Osborne said his austerity policies would cut his country’s budget deficit to zero within four years, enable Britain to begin relieving itself of its public debt, and generate healthy economic growth. None of these things have happened. Britain’s deficit remains stubbornly high, its people have been suffering through a double-dip recession, and many observers now expect the country to lose its ‘AAA’ credit rating.

At every stage of the experiment, critics have warned that Osborne’s austerity policies would prove self-defeating. Any decent economics textbook will tell you that, other things being equal, cutting government spending causes the economy’s overall output to fall, tax revenues to decrease, and spending on benefits to increase. Almost invariably, the end result is slower growth (or a recession) and high budget deficits. Osborne, relying on arguments about restoring the confidence of investors and businessmen that his forebears at the U.K. Treasury used during the early nineteen-thirties against Keynes, insisted (and continues to insist) otherwise, but he has been proven wrong.“

http://www.newyorker.com/online/blogs/comment/2012/12/austerity-economics-doesnt-work.html

And how many of those are part-time jobs? Some people are just working for eight hours a week, but that means they’re not classed as unemployed. One estimate last month said that there are six million people either underemployed (where they need more working hours to make ends meet) or unemployed.The country's jobless total fell by 82,000 in the three months to October, leaving 2.51million people looking for work - an unemployment rate of 7.8 per cent. 29.6 million Britons now have a job - the highest number in history.

Yes, there are more people with jobs than ever before in our history. There were three million more people in work under Labour than in 1997. Why? Because we have more people in the country than at any time in our history! If you want to use relevant statistics, go back to 1979 when Thatcher made much of 1.4 million unemployed with her 'Labour isn’t working' posters. And you’re boasting about only 2.51 million being unemployed? As I said, clutching at straws.

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

blueturando. Good to see that you haven’t lost your sense of humour! Or is that remark, based on one very misleading set of figures, just a sign of someone clutching at straws in a feeble attempt to defend the disastrous policies of this government?

Strange how any figures released that do not agree with your politics are all 'Misleading', but any other stats or figures made up or not that agree with your politics are??......well perfectly ok.....Funny that?

Seems Ed Miliband didn't think they were misleading

And how many of those are part-time jobs?

Part time jobs have reduced by 4000 as employer have changed them into 'Full time' roles

Because we have more people in the country than at any time in our history!

Another wonderfull legacy of New Labour

No one is boasting about 2.51 mil unemployed, but we are heading in the right direction, which is more than can be said for many of our EU neighbours

blueturando- Banned

- Posts : 1203

Join date : 2011-11-21

Age : 57

Location : Jersey CI

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

From Guido

Labour Taxed Poor More and Rich Less Than Coalition

With the dividing lines for the next election seemingly drawn at PMQs, one of Ed’s main attack lines is the claim that the Tories are hurting the poor and helping the rich. But do the stats back him up? According to HMRC these are the average income tax rates across the pay scale comparing Labour between 2009-10 and the Coalition for 2012-13:

You really should look at the link to see the graphs, though I'm there are some that will claim it's misleading?

http://order-order.com/2012/12/12/labour-taxed-poor-more-and-rich-less-than-coalition/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+guidofawkes+%28Guy+Fawkes%27+blog+of+parliamentary+plots%2C+rumours+and+conspiracy%29

Labour Taxed Poor More and Rich Less Than Coalition

With the dividing lines for the next election seemingly drawn at PMQs, one of Ed’s main attack lines is the claim that the Tories are hurting the poor and helping the rich. But do the stats back him up? According to HMRC these are the average income tax rates across the pay scale comparing Labour between 2009-10 and the Coalition for 2012-13:

You really should look at the link to see the graphs, though I'm there are some that will claim it's misleading?

http://order-order.com/2012/12/12/labour-taxed-poor-more-and-rich-less-than-coalition/?utm_source=feedburner&utm_medium=feed&utm_campaign=Feed%3A+guidofawkes+%28Guy+Fawkes%27+blog+of+parliamentary+plots%2C+rumours+and+conspiracy%29

tlttf- Banned

- Posts : 1029

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Judging by their sudden and confident appearance on the threads again, it looks like the 'Moody Blues' are back on the road...!

Phil Hornby- Blogger

- Posts : 4002

Join date : 2011-10-07

Location : Drifting on Easy Street

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

tlttf. LOL - to quote a friend of yours, "I wouldn't believe a single word that comes out of that poisonous man's mouth."From Guido

Can't you see further than the end of your nose? Guido (Paul Staines) doesn't compare 13 years of Labour with this evil government - he chooses one year after the credit crunch occurred with the current financial year, when the Lib Dems insisted on a big rise in the starting threshold for income tax in return for the 5% cut for millionaires. Neither does Staines take account of the VAT rise introduced by this shower, after they promised they wouldn't do any such thing.Labour Taxed Poor More and Rich Less Than Coalition....comparing Labour between 2009-10 and the Coalition for 2012-13

If you keep quiet, people may think you're a fool. When you post tripe like this, they know that you are. (And have you just learned the word 'tinted'? Some of us knew it a long time ago.)

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Phil Hornby wrote:Judging by their sudden and confident appearance on the threads again, it looks like the 'Moody Blues' are back on the road...!

But still preferring to discuss the perceived shortcomings of a PREVIOUS administration, rather than their own incumbents.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Experts urge caution over fall in unemployment

Extracts from an article by John Eccleston:-

Charles Levy, senior economist at The Work Foundation, said:-

"Today's labour market statistics show youth unemployment has dropped significantly. However, this pace of change can only be sustained if our economy is creating hundreds of thousands of new jobs every quarter. Unfortunately, in the three months to October the economy only created 40,000 new jobs, far fewer than we have seen recently. Employment among women actually fell by 13,000 over the period. However, rather than entering employment or full-time training, it appears that many 16- to-24 year olds are becoming economically inactive. It is too early to make predictions, but there is a real risk that these numbers will represent the end of the recent mini labour market recovery."

John Salt, director of totaljobs.com, said:-

"With Christmas on the horizon, we often see part-time and temporary jobs open up at this time of year. However, as with the Olympics, my concern is that the UK economy is being propped up by part-time or temporary workers and until we see growth in real job creation throughout the year, an underemployment bubble will continue to disguise the true picture of the UK's labour market. On top of this, the Chancellor's Autumn Statement left more of a wintery chill in the air, signalling that we are not through the worst of it and can expect unemployment to rise again next year, hitting young jobseekers and the North of England hardest."

http://www.personneltoday.com/articles/12/12/2012/59075/experts-urge-caution-over-fall-in-unemployment.htm

Extracts from an article by John Eccleston:-

Charles Levy, senior economist at The Work Foundation, said:-

"Today's labour market statistics show youth unemployment has dropped significantly. However, this pace of change can only be sustained if our economy is creating hundreds of thousands of new jobs every quarter. Unfortunately, in the three months to October the economy only created 40,000 new jobs, far fewer than we have seen recently. Employment among women actually fell by 13,000 over the period. However, rather than entering employment or full-time training, it appears that many 16- to-24 year olds are becoming economically inactive. It is too early to make predictions, but there is a real risk that these numbers will represent the end of the recent mini labour market recovery."

John Salt, director of totaljobs.com, said:-

"With Christmas on the horizon, we often see part-time and temporary jobs open up at this time of year. However, as with the Olympics, my concern is that the UK economy is being propped up by part-time or temporary workers and until we see growth in real job creation throughout the year, an underemployment bubble will continue to disguise the true picture of the UK's labour market. On top of this, the Chancellor's Autumn Statement left more of a wintery chill in the air, signalling that we are not through the worst of it and can expect unemployment to rise again next year, hitting young jobseekers and the North of England hardest."

http://www.personneltoday.com/articles/12/12/2012/59075/experts-urge-caution-over-fall-in-unemployment.htm

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Just love these people that are suddenly quoted, perhaps this thread should be called the invisible men. Accept it, the coalition are shyte yet the majority prefer them to Ed Balls and the Fffffantasies, they also prfer Gideon to Balls, now that says it all.

tlttf- Banned

- Posts : 1029

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

tlttf. Plenty of fantasies from you this morning, spread across the forum!the coalition are shyte yet the majority prefer them to Ed Balls and the Fffffantasies

Ipsos MORI (12 Dec): LAB 44%, CON 35%, LIB DEMS 9%, UKIP 7%.

YouGov (12 Dec): LAB 44%, CON 31%, LIB DEMS 12%, UKIP 9%.

UK Polling Report prediction: Labour overall majority of 112.

http://ukpollingreport.co.uk/

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Sorry I can't post reams of statistics etc on this theme - my mind doesn't seem to work that way.

However, at the end of a career spent helping poor and disabled people navigate their way around the benefit and social care systems, I am now getting my eyes opened to what deprivation really is.

Every week, alongside the disabled, ill and otherwise disadvantaged people who will always need help and support, I am seeing fathers and mothers of families, people who have taken a pride in providing for their families by hard work, asking for a referral to a food bank because, due to sickness, or a mistake in calculating their Tax Credits and/or Housing Benefit, they are in the position where they are unable to feed themselves or their children.

This situation, in a comparatively wealthy and supposedly civilised country, is, to my mind obscene and unacceptable. Due to progressive pay cuts and benefit cuts, these people no longer are able to plan for hard times by saving, and the benefit system, which was designed to provide a safety net, is not fit for purpose. I make many caslls in the week to benefit offices - each one takes on average 3-4 minutes before I actually get to speak to someone, who, more often than not is unable to help with the query, and I am directed to yet another office, with yet another long wait to speak to someone. This takes place while I sit at my ease in a warm office - I can only begin to imagine doing the same in a cold house with limited credit on my mobile phone, and surrounded by my hungry family.

I am aware that the poor will always be with us - that was the purpose of the NHS, free education and universal welfare. Now, I won't be surprised to see more and more people dying, destitute, in the streets, because we have a government that just does not care.

I sincerely hope Labour do get in at the next election - they may be the least worst option, but I have never had to witness this level of deprivation under a Labour government.

However, at the end of a career spent helping poor and disabled people navigate their way around the benefit and social care systems, I am now getting my eyes opened to what deprivation really is.

Every week, alongside the disabled, ill and otherwise disadvantaged people who will always need help and support, I am seeing fathers and mothers of families, people who have taken a pride in providing for their families by hard work, asking for a referral to a food bank because, due to sickness, or a mistake in calculating their Tax Credits and/or Housing Benefit, they are in the position where they are unable to feed themselves or their children.

This situation, in a comparatively wealthy and supposedly civilised country, is, to my mind obscene and unacceptable. Due to progressive pay cuts and benefit cuts, these people no longer are able to plan for hard times by saving, and the benefit system, which was designed to provide a safety net, is not fit for purpose. I make many caslls in the week to benefit offices - each one takes on average 3-4 minutes before I actually get to speak to someone, who, more often than not is unable to help with the query, and I am directed to yet another office, with yet another long wait to speak to someone. This takes place while I sit at my ease in a warm office - I can only begin to imagine doing the same in a cold house with limited credit on my mobile phone, and surrounded by my hungry family.

I am aware that the poor will always be with us - that was the purpose of the NHS, free education and universal welfare. Now, I won't be surprised to see more and more people dying, destitute, in the streets, because we have a government that just does not care.

I sincerely hope Labour do get in at the next election - they may be the least worst option, but I have never had to witness this level of deprivation under a Labour government.

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

I sincerely hope Labour do get in at the next election - they may be the least worst option, but I have never had to witness this level of deprivation under a Labour government

I would love to (once in my life) see a Labour government have to deal with a recession (they usuallly get voted out because they either help create it or have no idea what to do) You can be sure that they would either crumble due to in fighting and union pressure or borrow so much that eventually we would have a Spanish/Greek problem

blueturando- Banned

- Posts : 1203

Join date : 2011-11-21

Age : 57

Location : Jersey CI

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Not at all interested in point scoring, but I do wonder, if this government is one that does know what to do, they dont' seem to be showing very good form to date - increased borrowing, double (or is it triple?) dip recession and people dying in the streets - give me well meaning amateurs any day - at least the previous government were beginning to invest in development of a more equal society.

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

There may be two ways to describe the actions of this Tory-led Coalition that we currently enjoy.

1. The cock-up theory

or

2. The Conspiracy theory.

My own preference is for the latter. Prior to the General Election of 2010, David Cameron's pronouncements were soothing and emollient. The NHS was safe in their hands, Labour economic policies would be continued etc., etcetera.

Once in office, propped up by the yellow quisling Lib-Dems, however, Cameron discovered what being THE GOVERNMENT actually implied - he held the levers of Power in his hands. Others such as the Dirty Digger had already assimilated that fact, and introduced various American "Advisors" well-versed in Republican right-wing dogma. The tame Brits were indoctrinated with extreme views, and confirmed as Thatcher's natural successors.

Previous soft-pedalling was replaced by a determination to back Capitalism to the detriment of the working class. There is not now any alternative for the current administration. They are un-re-electable, but have two more years in which to advance their 1980s strategy.

1. The cock-up theory

or

2. The Conspiracy theory.

My own preference is for the latter. Prior to the General Election of 2010, David Cameron's pronouncements were soothing and emollient. The NHS was safe in their hands, Labour economic policies would be continued etc., etcetera.

Once in office, propped up by the yellow quisling Lib-Dems, however, Cameron discovered what being THE GOVERNMENT actually implied - he held the levers of Power in his hands. Others such as the Dirty Digger had already assimilated that fact, and introduced various American "Advisors" well-versed in Republican right-wing dogma. The tame Brits were indoctrinated with extreme views, and confirmed as Thatcher's natural successors.

Previous soft-pedalling was replaced by a determination to back Capitalism to the detriment of the working class. There is not now any alternative for the current administration. They are un-re-electable, but have two more years in which to advance their 1980s strategy.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

blueturando. If you want to see a Labour government, you know what to do at the next election…..I would love to (once in my life) see a Labour government have to deal with a recession (they usuallly get voted out because they either help create it or have no idea what to do) You can be sure that they would either crumble due to in fighting and union pressure or borrow so much that eventually we would have a Spanish/Greek problem

Can you provide some evidence to support your ‘Daily Mail’ prejudices? For example, when did Labour help to create a recession? I do recall that Labour presided over the longest recession-free period in our history, but don’t let that fact spoil your argument.

Labour came to power in 1945 and rebuilt the country after the decimation of war. I recall Labour coming to power in 1964 faced with a balance of payments crisis caused by the Tories, and coming to power in 1974 with double-digit inflation to contend with and the country working a three-day week. Even in 1997, after the Tories had tried to correct their own mistake of entering the ERM at too high an exchange rate and the subsequent disaster of ‘Black Wednesday’, Labour inherited a debt equal to 43.76% of GDP. Gordon Brown got that figure below 40% and kept it there until the global credit crunch overwhelmed everyone, especially those countries like Britain which are highly dependent on financial services.

If you bother to do some research, instead of just regurgitating tired old lies, you would see that the Tories have never been good at running the economy, and George Osborne is determined to ensure that this evil regime will be no exception to that rule.

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

blueturando said:

"I would love to (once in my life) see a Labour government have to deal with a recession (they usuallly get voted out because they either help create it or have no idea what to do) You can be sure that they would either crumble due to in fighting and union pressure or borrow so much that eventually we would have a Spanish/Greek problem".

Sorry bluey, but you must sleep very soundly to have missed the recessions we have suffered in your lifetime, but fear not my friend, I am here to assist you in your time of need.

Mid 70's Recession, 2 years, into recession 1973 (Ted Heath, Conservative) out of Recession 1975 (harold Wilson, Labour)

Early 80's Recession, 2 years, into recession 1980, out of recession 1982, all under Margaret Thatcher, Conservative.

Early 90's Recession, 2 years, into recession 1990, out of recession 1992, all under John Major, Conservative.

Late 2000's Recession, 1.25 years, into Recession 2008, out of recession 2009, all under Gordon Brown.

As you can clearly see bluey not one of the Recessions in your lifetime was caused by Labour, but its a shame for you that the same can not be said for your Tories.

bobby- Posts : 1939

Join date : 2011-11-18

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Can you provide some evidence to support your ‘Daily Mail’ prejudices? For example, when did Labour help to create a recession? I do recall that Labour presided over the longest recession-free period in our history, but don’t let that fact spoil your argument

Here's an idea that I will just throw out there Ivan. Yes your fact is correct, but then why were Labour still borrowing and not saving?

Why didn't they up the top rate of tax to 50p so that could build up the coffers to help cover us in the event of the next recession? It's a bit rich you all now saying that the tories have given rich people a tax break, but New Labour did that for 13 years and also failed to clamp down on the corporation tax avoidance that has now come to light. If they had done their job properly then maybe we wouldn't have been in the position we now find ourselves in and Gordon would have probably still be the PM.

So yes Labour did help to create the recession by not taxing the rich individuals or big business enough in the good times

blueturando- Banned

- Posts : 1203

Join date : 2011-11-21

Age : 57

Location : Jersey CI

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

blueturando. That remark suggests a basic lack of understanding of economics. Increasing taxation reduces growth by sucking demand out of the economy and makes a recession more likely. Maybe extra taxation on the rich (whose money is less likely to be spent and may be stashed in off-shore accounts) could help the economy, but only if the revenue raised was then spent by the government on projects, such as house building, which create new jobs and in turn more demand.So yes Labour did help to create the recession by not taxing the rich individuals or big business enough in the good times

Cutting taxes too fast can also lead to a recession – after a boom – as Nigel Lawson proved with his 1988 budget, which drastically overheated the economy, making high interest rates necessary to control inflation. A part of Thatcher’s legacy was to leave office in 1990 with inflation at 10%. It was that kind of 'boom and bust' – created by politicians – which Gordon Brown said had been abolished, and that was partly achieved by taking control of interest rates away from politicians (who had been inclined to create booms shortly before elections, to make people feel prosperous) and handing it to the Bank of England.

The top rate of income tax was 60% from 1979 until Lawson’s budget of 1988, when he slashed it to 40%. I’ve always thought that Labour should have increased that top rate on coming to power, but Blair didn’t think so and neither did Mandelson, who declared: "We are intensely relaxed about people getting filthy rich". Maybe that didn’t seem to matter so much in the good times.

https://cuttingedge2.forumotion.co.uk/t709-does-inequality-matter

Labour didn’t cause the collapse of Lehman Brothers by creating record numbers of doctors, nurses, teachers and policemen. Thatcher made this country heavily dependent on financial services, and so we were bound to take a massive hit. Stashing a few quid in the Bank of England wouldn’t have saved us from the overwhelming effects of a global credit crunch which few people saw coming. Peter Doyle was a senior economist at the International Monetary Fund, and he accused the organisation of suppressing warnings that the global economic system was heading for a crash:-

http://www.independent.co.uk/news/business/news/furious-imf-official-attacks-its-tainted-leadership-7962560.html

You may recall that in those pre-crash days, the Tories were promising to match Labour’s spending plans. Of course that was conveniently forgotten by 2010, when Osborne kept repeating his trite remark that “Labour didn’t fix the roof while the sun was shining”. Yes Labour did, it fixed the school roof and the hospital roof after years of neglect.

We’re told that Vince Cable predicted the global meltdown. Well you can always find someone to make predictions, and sooner or later some of them will prove correct; a clock that doesn’t work still tells the correct time twice a day. The Tories predicted that the introduction of the minimum wage in 1998 would cause a recession, but they got that wrong. Some halfwits keep telling us that the world will end on 21 December this year, but I predict that it won’t; it just feels like it’s ending the longer this vile government of thoroughly nasty and vicious individuals stays in power.

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

"La nuit, tous les chats son gris"

At night, all cats are grey.

To distinguish one politician from another is no easy task.

At night, all cats are grey.

To distinguish one politician from another is no easy task.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

I wonder why we are still talking about Britain's Economic Data when we know that all governments manipulate it to suit their own agenda.....

More important thing to look at is the fact that there is a need for an ever growing number of Food Banks........

I don't seem to remember these back in the bad old days of Thatcher......So it really does mean that this bunch, now in government, destroying the country are far worse than Thatcher...... Fact........

More important thing to look at is the fact that there is a need for an ever growing number of Food Banks........

I don't seem to remember these back in the bad old days of Thatcher......So it really does mean that this bunch, now in government, destroying the country are far worse than Thatcher...... Fact........

astradt1- Moderator

- Posts : 966

Join date : 2011-10-08

Age : 69

Location : East Midlands

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

The 1930s had The Jarrow March; Ted Heath's London had Soup Kitchens and up to three million people in Britain urgently needed re-housing because they were living in damp, overcrowded slum conditions, according to housing charity Shelter. Thatcher's Britain produced cardboard cities and the Cameron government ushered in Food Banks.

Anyone spot the common denominator?

Anyone spot the common denominator?

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Osborne's economic strategy has failed

Extracts from an article by Larry Elliott:-

"The strategy has failed. The public knows it. The IMF knows it. The credit rating agencies know it. Even Osborne knows it, although he can't bring himself to admit as much.

National output has just contracted for the fourth quarter in the last five. The only quarter of 2012 in which the economy expanded was the one that contained the London Olympics, and unfortunately for the Chancellor, this sort of jamboree happens once every half century rather than once every three months. During 2012 as a whole the economy registered no growth at all.

The level of GDP is 3% below where it was when the recession started, a weaker performance than during the 1930s. Industrial production was to blame for the drop in output in the final three months of 2012, with factory output back to levels last seen in the early 1990s. Rebalancing is a pipedream. Unsurprisingly, the Treasury's deficit reduction programme is well off track. This is an abysmal record. Politically, as well as economically, these figures are a disaster for the government.

All sorts of excuses can be trotted out to explain away the fact that three years after the recession first ended GDP is still contracting. But the government also sucked demand out of the economy by raising taxes, cutting welfare and by taking the axe to capital spending programmes. The blood-curdling rhetoric from Osborne in 2010 about Britain being a Greece-in-waiting had the entirely predictable effect of shredding consumer and business confidence."

For the whole article:-

http://www.guardian.co.uk/business/economics-blog/2013/jan/25/george-osborne-economic-strategy-failed-gdp

Extracts from an article by Larry Elliott:-

"The strategy has failed. The public knows it. The IMF knows it. The credit rating agencies know it. Even Osborne knows it, although he can't bring himself to admit as much.

National output has just contracted for the fourth quarter in the last five. The only quarter of 2012 in which the economy expanded was the one that contained the London Olympics, and unfortunately for the Chancellor, this sort of jamboree happens once every half century rather than once every three months. During 2012 as a whole the economy registered no growth at all.

The level of GDP is 3% below where it was when the recession started, a weaker performance than during the 1930s. Industrial production was to blame for the drop in output in the final three months of 2012, with factory output back to levels last seen in the early 1990s. Rebalancing is a pipedream. Unsurprisingly, the Treasury's deficit reduction programme is well off track. This is an abysmal record. Politically, as well as economically, these figures are a disaster for the government.

All sorts of excuses can be trotted out to explain away the fact that three years after the recession first ended GDP is still contracting. But the government also sucked demand out of the economy by raising taxes, cutting welfare and by taking the axe to capital spending programmes. The blood-curdling rhetoric from Osborne in 2010 about Britain being a Greece-in-waiting had the entirely predictable effect of shredding consumer and business confidence."

For the whole article:-

http://www.guardian.co.uk/business/economics-blog/2013/jan/25/george-osborne-economic-strategy-failed-gdp

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

But will Cameron have the guts to reshuffle his Chancellor of the Exchequer?

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Austerity doesn't seem to have damaged the domestic sales of new Motor Cars in the UK, which are up by 11.5% on this time last year, according to the Society of Motor Manufactureres and Traders.

My belief is that people can usually afford the things they want to afford, though they can't ALL be Ministerial Cars, despite appearances.

My belief is that people can usually afford the things they want to afford, though they can't ALL be Ministerial Cars, despite appearances.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Austerity just doesn't work!

"A widening gap between rich and poor, people staying indoors rather than going shopping in the snow, and profits slumps at consumer goods companies paint a bleak picture for the start of this year.

Although there have been recoveries in the markets, Britons are still struggling with the impact of the financial crisis, which has now lasted almost as long as the Second World War."

For the rest of the article:-

http://www.independent.co.uk/news/business/news/bleak-start-to-2013-as-poorest--uk-households-feel-the-squeeze-8498667.html

"A widening gap between rich and poor, people staying indoors rather than going shopping in the snow, and profits slumps at consumer goods companies paint a bleak picture for the start of this year.

Although there have been recoveries in the markets, Britons are still struggling with the impact of the financial crisis, which has now lasted almost as long as the Second World War."

For the rest of the article:-

http://www.independent.co.uk/news/business/news/bleak-start-to-2013-as-poorest--uk-households-feel-the-squeeze-8498667.html

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

But the London Stock Exchange keeps surging ahead.

FTSE 100 Onward and upward for the past eight months.

What have we misunderstood?

FTSE 100 Onward and upward for the past eight months.

What have we misunderstood?

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

oftenwrong wrote:But the London Stock Exchange keeps surging ahead.

FTSE 100 Onward and upward for the past eight months.

What have we misunderstood?

Nothing, I think. Crisis and austerity force down wages and winnows out competitors - for the 'chosen few', it's good news. That's why they keep pushing it.

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

It's good news for those whose companies are making a profit - less so for the rest of us

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

if you can't beat 'em, join 'em

Also, if you can't lick 'em, join 'em. If you can't defeat your opponents you might be better off by switching to their side. For example, Seeing that no one else was willing to stick with the old software program, Marcia learned the new one, noting if you can't beat 'em, join 'em , or I opposed a new school library, but the town voted for it, so I'll support it.

Or you could try to find out why some people manage to make money in good times and in bad.

Also, if you can't lick 'em, join 'em. If you can't defeat your opponents you might be better off by switching to their side. For example, Seeing that no one else was willing to stick with the old software program, Marcia learned the new one, noting if you can't beat 'em, join 'em , or I opposed a new school library, but the town voted for it, so I'll support it.

Or you could try to find out why some people manage to make money in good times and in bad.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Some people always can - everyone can't unless there is some form of fair redistribution - always winners and losers - we need to redistribute the goodies so the losers have less disadvantage.

Personally, I'm not against anyone making money - it just seems to me wrong, that, in order for a minority to make money a large minority have to experience poverty and social exclusion.

Put it another way - if we're all out there being entrepreneurs, who will buy our goods and services, thereby making us rich, and who will bring up the babies, clean the houses, empty the dustbins etc etc

'They also serve, who only stand and wait' as I think a famous disabled person once said.

Personally, I'm not against anyone making money - it just seems to me wrong, that, in order for a minority to make money a large minority have to experience poverty and social exclusion.

Put it another way - if we're all out there being entrepreneurs, who will buy our goods and services, thereby making us rich, and who will bring up the babies, clean the houses, empty the dustbins etc etc

'They also serve, who only stand and wait' as I think a famous disabled person once said.

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Austerity almost never works

Extracts from an article by Aditya Chakrabortty:-

Vince Cable is shocked that he's been sharing a coalition with Tories waging an "ideological jihad" on public services. As if to back him up, Liam Fox obligingly decried Tony Blair's "great socialist coup", and called for a £345bn cut in public spending, as well as a complete suspension of capital gains tax (this last measure doesn't actually feature in General Pinochet's Little Book of Counter-Revolution – but from tiny acorns and all that).

Fox fits snugly into his former cabinet colleague's pigeonhole. Yet if the Business Secretary thinks he has to fend off a few austerity jihadists, he should think again; he's in a government full of them. If one definition of an ideologue is one who clings on to a strategy long after it's been proven to be a failure, then on deficit reduction Cameron is as swivel-eyed as they come. Last week, he claimed "signs that our plan is beginning to work", but next Wednesday will see Osborne deliver yet another budget in which growth forecasts are lowered, borrowing projections raised and even more spending cuts laid out. This will be completely in line with every other budget and mini-budget the Chancellor has delivered since he first laid out Plan A.

The most famous episode of austerity was during the interwar years, as Germany, Britain, France and Japan all fought to stay on the Gold Standard even amid the Great Depression. The deflationary impact of keeping their currencies pegged to gold, along with the austerity policies they followed to do so, was disastrous.

For the entire article:-

http://m.guardian.co.uk/commentisfree/2013/mar/11/austerity-almost-never-works

Extracts from an article by Aditya Chakrabortty:-

Vince Cable is shocked that he's been sharing a coalition with Tories waging an "ideological jihad" on public services. As if to back him up, Liam Fox obligingly decried Tony Blair's "great socialist coup", and called for a £345bn cut in public spending, as well as a complete suspension of capital gains tax (this last measure doesn't actually feature in General Pinochet's Little Book of Counter-Revolution – but from tiny acorns and all that).

Fox fits snugly into his former cabinet colleague's pigeonhole. Yet if the Business Secretary thinks he has to fend off a few austerity jihadists, he should think again; he's in a government full of them. If one definition of an ideologue is one who clings on to a strategy long after it's been proven to be a failure, then on deficit reduction Cameron is as swivel-eyed as they come. Last week, he claimed "signs that our plan is beginning to work", but next Wednesday will see Osborne deliver yet another budget in which growth forecasts are lowered, borrowing projections raised and even more spending cuts laid out. This will be completely in line with every other budget and mini-budget the Chancellor has delivered since he first laid out Plan A.

The most famous episode of austerity was during the interwar years, as Germany, Britain, France and Japan all fought to stay on the Gold Standard even amid the Great Depression. The deflationary impact of keeping their currencies pegged to gold, along with the austerity policies they followed to do so, was disastrous.

For the entire article:-

http://m.guardian.co.uk/commentisfree/2013/mar/11/austerity-almost-never-works

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

"The most famous episode of austerity was during the interwar years, as Germany, Britain, France and Japan all fought to stay on the Gold Standard even amid the Great Depression. The deflationary impact of keeping their currencies pegged to gold, along with the austerity policies they followed to do so, was disastrous."

Don't mention the Eurozone!

Don't mention the Eurozone!

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

It’s even worse than was thought

(An article by Michael Burke, reproduced in full with the permission of the source)

"The latest GDP release from the Office for National Statistics was accompanied by a set of revisions to previous data. These now show that the downturn was more severe than had previously been estimated and that the British economy is even further away from recovery.

Previously, ONS data had shown that six years into economic slump the economy was still 2.6% below its pre-recession peak in the 1st quarter of 2008. Now it shows that the economy is actually 3.9% below its peak.

The economy is still £61bn below the peak level. Yet it remains the case that the fall in investment more than accounts for the entirety of the recession, as shown in Fig. 1. Investment (Gross Fixed Capital Formation) has fallen by £68bn. The other main component of GDP which has contracted is household consumption, which is down by £28bn. This demonstrates the effects of falling real wages on living standards. It effectively accounts for half the recession, but it is not as severe as the decline in investment.

By contrast government spending is £20bn higher, despite all the propaganda about the absolute priority of deficit reduction. This is because government policy is not primarily aimed at curbing spending at all, otherwise PFI, Trident and subsidies to corporations would all go. The aim is to boost profits, which means cutting wages, cutting government investment in areas where the private sector can return profits and redirecting the social surplus towards capital.

Net exports are also £32bn higher. The government and its supporters are inclined to blame Europe, or foreigners in general for their own failed economic policy. It should be noted that the rise in net exports has very little to do with the increased sale of goods and services overseas. Despite a very large devaluation for Sterling exports are only £6bn higher at the beginning of 2013 than at the beginning of 2008. By far the larger component of the rise in net exports has been the fall in imports, down £26bn over the same period. It seems that both households and firms in Britain are being priced out of world markets. It should be clear from the much greater fall in imports that it is Britain which is a drag on the world economy, not vice versa.

In fact the British economy has been one of the worst performers in the G7, which itself has performed very poorly. As a whole the G7 economy is just 1.1% above its pre-recession peak at the beginning of 2008. The British economy’s performance still 3.9% below its prior peak placing it in the rear of the G7, on a par with Japan and ahead only of Berlusconi’s Italy.

The slump has been followed by stagnation. The effect of the downward revisions to GDP is to increase the gap between the economy’s previous trend rate of growth and its current level. As a result the economy is already nearly 20% below its previous trend rate and even on official forecasts that gap is set to widen over the next period. The economy is about £350bn below its previous trend. This gives a measure of the scale of the crisis facing an incoming Labour government, which cannot be remedied without a commensurate level of investment in the economy.

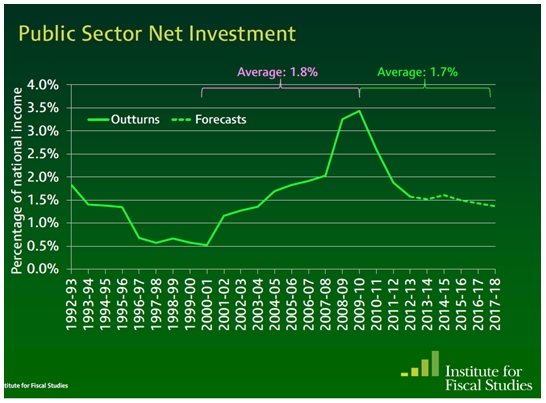

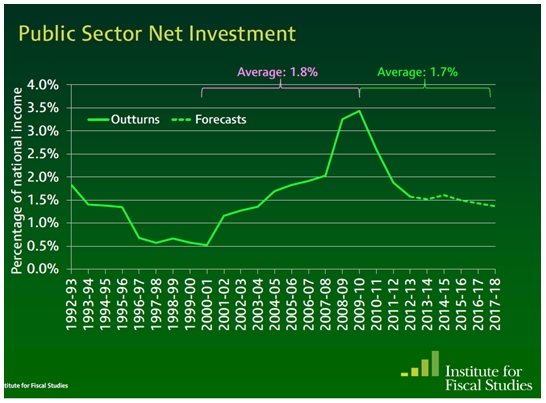

The Tory-led government has no intention of increasing investment. The much-hyped infrastructure investment plan was entirely fake. As the chart from the Institute for Fiscal Studies reproduced below shows, government investment is being cut.

The Tories regard the returns available from this investment as belonging to the private sector. The cut to investment is to allow the private firms to invest and so reap the benefits. But there is no evidence that the private sector regards these as sufficiently profitable. As a result the cuts to government investment are simply exacerbating the slump in private investment. A Labour government would need to break this investment strike through a very large increase in government investment."

http://socialisteconomicbulletin.blogspot.co.uk/2013/07/its-even-worse-than-was-thought.html

(An article by Michael Burke, reproduced in full with the permission of the source)

"The latest GDP release from the Office for National Statistics was accompanied by a set of revisions to previous data. These now show that the downturn was more severe than had previously been estimated and that the British economy is even further away from recovery.

Previously, ONS data had shown that six years into economic slump the economy was still 2.6% below its pre-recession peak in the 1st quarter of 2008. Now it shows that the economy is actually 3.9% below its peak.

The economy is still £61bn below the peak level. Yet it remains the case that the fall in investment more than accounts for the entirety of the recession, as shown in Fig. 1. Investment (Gross Fixed Capital Formation) has fallen by £68bn. The other main component of GDP which has contracted is household consumption, which is down by £28bn. This demonstrates the effects of falling real wages on living standards. It effectively accounts for half the recession, but it is not as severe as the decline in investment.

By contrast government spending is £20bn higher, despite all the propaganda about the absolute priority of deficit reduction. This is because government policy is not primarily aimed at curbing spending at all, otherwise PFI, Trident and subsidies to corporations would all go. The aim is to boost profits, which means cutting wages, cutting government investment in areas where the private sector can return profits and redirecting the social surplus towards capital.

Net exports are also £32bn higher. The government and its supporters are inclined to blame Europe, or foreigners in general for their own failed economic policy. It should be noted that the rise in net exports has very little to do with the increased sale of goods and services overseas. Despite a very large devaluation for Sterling exports are only £6bn higher at the beginning of 2013 than at the beginning of 2008. By far the larger component of the rise in net exports has been the fall in imports, down £26bn over the same period. It seems that both households and firms in Britain are being priced out of world markets. It should be clear from the much greater fall in imports that it is Britain which is a drag on the world economy, not vice versa.

In fact the British economy has been one of the worst performers in the G7, which itself has performed very poorly. As a whole the G7 economy is just 1.1% above its pre-recession peak at the beginning of 2008. The British economy’s performance still 3.9% below its prior peak placing it in the rear of the G7, on a par with Japan and ahead only of Berlusconi’s Italy.

The slump has been followed by stagnation. The effect of the downward revisions to GDP is to increase the gap between the economy’s previous trend rate of growth and its current level. As a result the economy is already nearly 20% below its previous trend rate and even on official forecasts that gap is set to widen over the next period. The economy is about £350bn below its previous trend. This gives a measure of the scale of the crisis facing an incoming Labour government, which cannot be remedied without a commensurate level of investment in the economy.

The Tory-led government has no intention of increasing investment. The much-hyped infrastructure investment plan was entirely fake. As the chart from the Institute for Fiscal Studies reproduced below shows, government investment is being cut.

The Tories regard the returns available from this investment as belonging to the private sector. The cut to investment is to allow the private firms to invest and so reap the benefits. But there is no evidence that the private sector regards these as sufficiently profitable. As a result the cuts to government investment are simply exacerbating the slump in private investment. A Labour government would need to break this investment strike through a very large increase in government investment."

http://socialisteconomicbulletin.blogspot.co.uk/2013/07/its-even-worse-than-was-thought.html

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Well that's a surprise. All of us who recognised a "Chancer who was winging it" in Gideon Osborne are proved to have been correct.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Austerity needs to stop.

Austerity needs to stop.

Austerity needs to stop – this was the big message put forward by union leaders during yesterday’s TUC conference. No ifs. No buts. The anti-cuts rhetoric was shared almost unanimously by trade unions; a rare solidarity, but surely a reflection of the attitudes of British working people? I’m pleased that Ed Miliband has embraced most of the concerns discussed at yesterday’s event, however he’s yet to form a decisive opinion on how to deal with Conservative-led budget cuts and privatizations. Today though, that isn’t as significant. The tension between Labour and the unions has, for the most part, cooled down – this is the most important thing to come out of the conference. Now that tension has died down, Labour has an opportunity to seriously take on board what the unions and working people all over the country are saying.

“It is up to us – not just to fight back industrially, but to build a mass movement, by building a social consensus, a coalition for change, amongst organised and unorganised workers, campaign groups, the People’s Assembly, churches and charities, as well as direct action and grassroots organisations.” – Steve Turner, Unite Executive of Policy.

It’s not often we hear such calls from union leaders, especially in the last decade – a time in which trade union leaders have been most reluctant to take strike action. That said, I really believe that yesterday’s discussions are a reflection of the wants and needs of the British public. As Tony Benn said, we’re living in a time when the views of the British majority are more left-wing than the views of the mainsteam political parties. This, electorally, is something Labour need to take advantage of. While it may be tempting for Oxford-read Labour leaders to adopt ‘Tory-lite’ policies, the real victory for Labour will come when it begins addressing the calls being made from the working groundfloor of the party.

Unfortunately, Ed Miliband was sure to finish his talks with a mention of ‘limitations’ put upon the budget by the growing deficit. I am hoping that this doesn’t mean Miliband will be taking the stance of ‘austerity, just less of it’. This would go directly against what many of our union leaders are saying. Quoting Steve Turner again, if we have got money to propose war on Syria, we’ve got money to wage war on food banks; to put our people back to work; our children into school and university – not debt and despair – and to provide dignity for our elderly. It’s true though, if in World War 2 we were able to conscript 1.5 million men to fight for our country – why can we not do the same again, but this time have our men and women building hospitals, schools and improving the nation. Through actually enforcing taxation on current big businesses, we could reduce our deficit while building a better nation for everybody.

---

This article has been cross-posted from the Critical Proletariat. http://www.criticalproletariat.com

“It is up to us – not just to fight back industrially, but to build a mass movement, by building a social consensus, a coalition for change, amongst organised and unorganised workers, campaign groups, the People’s Assembly, churches and charities, as well as direct action and grassroots organisations.” – Steve Turner, Unite Executive of Policy.

It’s not often we hear such calls from union leaders, especially in the last decade – a time in which trade union leaders have been most reluctant to take strike action. That said, I really believe that yesterday’s discussions are a reflection of the wants and needs of the British public. As Tony Benn said, we’re living in a time when the views of the British majority are more left-wing than the views of the mainsteam political parties. This, electorally, is something Labour need to take advantage of. While it may be tempting for Oxford-read Labour leaders to adopt ‘Tory-lite’ policies, the real victory for Labour will come when it begins addressing the calls being made from the working groundfloor of the party.

Unfortunately, Ed Miliband was sure to finish his talks with a mention of ‘limitations’ put upon the budget by the growing deficit. I am hoping that this doesn’t mean Miliband will be taking the stance of ‘austerity, just less of it’. This would go directly against what many of our union leaders are saying. Quoting Steve Turner again, if we have got money to propose war on Syria, we’ve got money to wage war on food banks; to put our people back to work; our children into school and university – not debt and despair – and to provide dignity for our elderly. It’s true though, if in World War 2 we were able to conscript 1.5 million men to fight for our country – why can we not do the same again, but this time have our men and women building hospitals, schools and improving the nation. Through actually enforcing taxation on current big businesses, we could reduce our deficit while building a better nation for everybody.

---

This article has been cross-posted from the Critical Proletariat. http://www.criticalproletariat.com

James Gibson- Posts : 19

Join date : 2013-07-27

Re: Does new economic data show that austerity does not work?

Re: Does new economic data show that austerity does not work?

Austerity illusions and debt delusions

66 months after the recession started, the British economy is still 3% smaller than it was in 2008. Austerity hasn’t worked and it won’t work. Austerity-lite is not much better. There can be no compromise with a failed idea.

Since 1980, income and wealth have been massively redistributed towards the super-rich and away from working class and middle class people. In the UK, the living standards debate is a constant reminder that austerity and current government policies act in the interest of the richest 1% of society. Millionaires enjoy tax cuts, while millions fall victim to tax increases and service cuts.

This pamphlet has been produced to expose the government’s lies and prove that there are alternative routes back to jobs, higher living standards and economic recovery:-

http://classonline.org.uk/docs/2013_austerity_illusions_and_debt_delusions.pdf

66 months after the recession started, the British economy is still 3% smaller than it was in 2008. Austerity hasn’t worked and it won’t work. Austerity-lite is not much better. There can be no compromise with a failed idea.

Since 1980, income and wealth have been massively redistributed towards the super-rich and away from working class and middle class people. In the UK, the living standards debate is a constant reminder that austerity and current government policies act in the interest of the richest 1% of society. Millionaires enjoy tax cuts, while millions fall victim to tax increases and service cuts.

This pamphlet has been produced to expose the government’s lies and prove that there are alternative routes back to jobs, higher living standards and economic recovery:-