Tax avoidance....the great rot?

+8

boatlady

tlttf

Stox 16

bobby

astra

oftenwrong

Papaumau

witchfinder

12 posters

:: The Heavy Stuff :: UK Economics

Page 2 of 2

Page 2 of 2 •  1, 2

1, 2

Is Vodaphone the world's largest tax fiddler?

Is Vodaphone the world's largest tax fiddler?

First topic message reminder :

In the UK and the US new kinds of protest have emerged over the last couple of years, these include so called "flash protests", occupations and sit-ins, a protest today can be organised quickly and easily using modern communications and the computor.

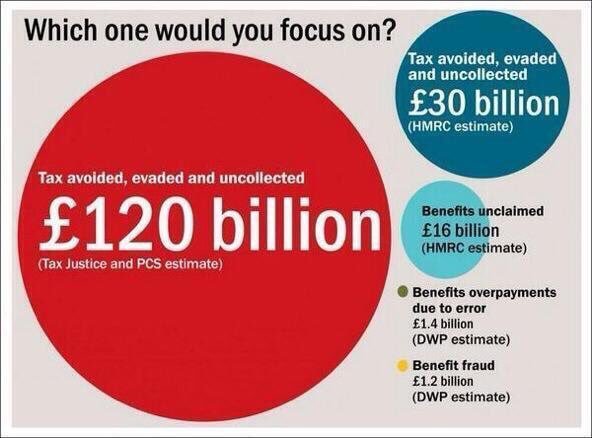

One of the biggest targets has been multi national businesses and big corporations who are accused of avoiding tax, the idea that hospitals, schools and welfare is been cut whilst big business gets away with paying not millions, but BILLIONS of pounds in tax makes many peoples blood boil.

The High Court in India has this week ruled that UK company Vodaphone is not liable to pay £2.8 billion because the Indian assets of China s "Hutchinson Telecom" were registered in the Cayman Islands when Vodaphone purchased them.

Does this mean that if a person from the Cayman Islands sold property that he or she owned in the United Kingdom, they would not have to pay stamp duty or CGT ? - No of course it dosent, it only applies to very big, very wealthy business.

In the UK and the US new kinds of protest have emerged over the last couple of years, these include so called "flash protests", occupations and sit-ins, a protest today can be organised quickly and easily using modern communications and the computor.

One of the biggest targets has been multi national businesses and big corporations who are accused of avoiding tax, the idea that hospitals, schools and welfare is been cut whilst big business gets away with paying not millions, but BILLIONS of pounds in tax makes many peoples blood boil.

The High Court in India has this week ruled that UK company Vodaphone is not liable to pay £2.8 billion because the Indian assets of China s "Hutchinson Telecom" were registered in the Cayman Islands when Vodaphone purchased them.

Does this mean that if a person from the Cayman Islands sold property that he or she owned in the United Kingdom, they would not have to pay stamp duty or CGT ? - No of course it dosent, it only applies to very big, very wealthy business.

witchfinder- Forum Founder

- Posts : 703

Join date : 2011-10-07

Location : North York Moors

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Writer Peter Oborne resigned as The Daily Telegraph‘s chief political commentator over HSBC’s coverage, calling it a “fraud on readers.”

http://tribune.com.pk/story/840074/fraud-on-the-readers-peter-oborne-resigns-from-british-newspaper-over-hsbc-reporting/

http://tribune.com.pk/story/840074/fraud-on-the-readers-peter-oborne-resigns-from-british-newspaper-over-hsbc-reporting/

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Private equity bosses using £700m tax ‘loophole’ – and donating to the Tories

Millionaire executives at private-equity firms are avoiding up to £700m in tax a year using a loophole which George Osborne has repeatedly failed to close.

16 private-equity bosses belong to the Conservative Party’s elite Leaders Group of major donors, giving more than £7m to the Tories since 2008.

More details here:-

http://www.independent.co.uk/news/uk/politics/private-equity-bosses-using-700m-tax-loophole--and-donating-to-the-tories-10054911.html

Millionaire executives at private-equity firms are avoiding up to £700m in tax a year using a loophole which George Osborne has repeatedly failed to close.

16 private-equity bosses belong to the Conservative Party’s elite Leaders Group of major donors, giving more than £7m to the Tories since 2008.

More details here:-

http://www.independent.co.uk/news/uk/politics/private-equity-bosses-using-700m-tax-loophole--and-donating-to-the-tories-10054911.html

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

You would think the 80 people who own more wealth than 3.5 billion people - half the planets population, would be happy to get the rounds in and pay for dinner - instead of allowing their fellow beings to starve and struggle in poverty. Welfare cuts are totally unnecessary. Austerity is totally unnecessary.

It's a bit like winning the lottery, going out with all your mates to celebrate, and then just sticking on your own when it comes to getting drinks in.

It's a bit like winning the lottery, going out with all your mates to celebrate, and then just sticking on your own when it comes to getting drinks in.

sickchip- Posts : 1152

Join date : 2011-10-11

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Facebook probably paid less tax than you last year

http://www.theguardian.com/global/2015/oct/11/facebook-paid-4327-corporation-tax-despite-35-million-staff-bonuses

http://www.theguardian.com/global/2015/oct/11/facebook-paid-4327-corporation-tax-despite-35-million-staff-bonuses

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Compared with some places, the UK corporation tax at 20% makes us a "tax haven" for Business. In the US it is 35% and some States also apply a local tax between 0% and 12%. The President is trying to make offshore evasions of US Taxes illegal, but a Republican (Trump?) administration might just reverse that upon election.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Wonder if this had anything to do with it?

Staff are quitting HMRC in their highest numbers for four years, according to accountancy firm UHY Hacker Young, as HMRC comes under growing pressure to improve its performance.

http://www.accountingweb.co.uk/article/hmrc-loses-highest-number-staff-four-years/549454

Staff are quitting HMRC in their highest numbers for four years, according to accountancy firm UHY Hacker Young, as HMRC comes under growing pressure to improve its performance.

http://www.accountingweb.co.uk/article/hmrc-loses-highest-number-staff-four-years/549454

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

EU proposals will force multinationals to disclose tax arrangements

US multinationals such as Google, Facebook and Amazon will be forced to publicly disclose their earnings and tax bills in Europe, under legislation being drafted by the EU executive.

The European commission is to table legislation in early April aimed at making the world’s largest multinational corporations open their tax arrangements with EU governments to full public scrutiny.

According to three senior EU officials familiar with the proposals, initial conclusions from an ongoing impact assessment have found in favour of obliging large corporations to reveal their profits and the tax they pay in every country in which they operate within the EU.

http://www.theguardian.com/world/2016/feb/07/eu-multinationals-tax-arrangements-us-google-amazon

US multinationals such as Google, Facebook and Amazon will be forced to publicly disclose their earnings and tax bills in Europe, under legislation being drafted by the EU executive.

The European commission is to table legislation in early April aimed at making the world’s largest multinational corporations open their tax arrangements with EU governments to full public scrutiny.

According to three senior EU officials familiar with the proposals, initial conclusions from an ongoing impact assessment have found in favour of obliging large corporations to reveal their profits and the tax they pay in every country in which they operate within the EU.

http://www.theguardian.com/world/2016/feb/07/eu-multinationals-tax-arrangements-us-google-amazon

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Would Brexit help us clamp down on tax avoidance?

From an article by Molly Scott Cato MEP:-

"The 11.5 million documents that make up the Panama Papers reveal the shocking scale of tax avoidance around the globe. More than half of the 300,000 firms listed as clients of corporate service provider Mossack Fonseca were registered in the UK or British-administered tax havens.

Osborne’s claim to be cracking down on tax avoidance is exposed as completely hollow by the Panama Papers. Indeed the revelations suggest past and present members of the government and their donors are using tax havens to avoid paying their fair share of tax. But obstruction is the name of the game when it comes to tackling tax avoidance; the government privately lobbied the EU to remove Bermuda from an official blacklist of tax havens, a place where Google reportedly amassed £30bn in profits. Not surprising perhaps, given the irony that HMRC rents its 600 regional offices from a company based in Bermuda. And now we learn Cameron intervened personally to prevent offshore trusts being included in an EU-wide crackdown on tax avoidance, and that he personally gained from cash in his father’s offshore firm.

Since deregulation is a common ambition of the majority of Leave campaigners, the likelihood is that a UK outside the EU would enable tax dodgers to bypass EU efforts to combat the problem. It therefore stands to reason that a post-Brexit UK would likely operate in a way that facilitates even more tax avoidance."

http://leftfootforward.org/2016/04/would-brexit-help-us-clamp-down-on-tax-avoidance/

From an article by Molly Scott Cato MEP:-

"The 11.5 million documents that make up the Panama Papers reveal the shocking scale of tax avoidance around the globe. More than half of the 300,000 firms listed as clients of corporate service provider Mossack Fonseca were registered in the UK or British-administered tax havens.

Osborne’s claim to be cracking down on tax avoidance is exposed as completely hollow by the Panama Papers. Indeed the revelations suggest past and present members of the government and their donors are using tax havens to avoid paying their fair share of tax. But obstruction is the name of the game when it comes to tackling tax avoidance; the government privately lobbied the EU to remove Bermuda from an official blacklist of tax havens, a place where Google reportedly amassed £30bn in profits. Not surprising perhaps, given the irony that HMRC rents its 600 regional offices from a company based in Bermuda. And now we learn Cameron intervened personally to prevent offshore trusts being included in an EU-wide crackdown on tax avoidance, and that he personally gained from cash in his father’s offshore firm.

Since deregulation is a common ambition of the majority of Leave campaigners, the likelihood is that a UK outside the EU would enable tax dodgers to bypass EU efforts to combat the problem. It therefore stands to reason that a post-Brexit UK would likely operate in a way that facilitates even more tax avoidance."

http://leftfootforward.org/2016/04/would-brexit-help-us-clamp-down-on-tax-avoidance/

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Tax Law is complicated due to continuous modifications required to close every loophole discovered by highly qualified people whose job it is to advise business on ways to maximise profits. Governments can also find themselves playing both sides, as in Offshore former colonies such as BVI and Cayman, originally granted tax-free status with the intention of making them self-supporting.

The British taxpayer is grudgingly resigned to meeting the enormous subsidy necessary to maintain a presence in the Falklands, but would almost certainly cough at similar expenses incurred in keeping all those other pink dots on a World map if deprived of their independent sources of income.

The British taxpayer is grudgingly resigned to meeting the enormous subsidy necessary to maintain a presence in the Falklands, but would almost certainly cough at similar expenses incurred in keeping all those other pink dots on a World map if deprived of their independent sources of income.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

‘The Guardian’ view on corruption: David Cameron should look closer to home

There are times when a manual earth-restructuring implement is best referred to as a spade, so let us speak plainly. A summit on corruption will be held on Thursday in a city that is internationally recognised (by the IMF, among others) as a tax haven. It is being hosted by a politician who admitted last month that he has personally profited from offshore finance and whose party is bankrolled by an industry that makes extravagant use of those same tax havens. Not only that, he has intervened to aid tax avoiders. That’s right, David Cameron is holding a meeting on corruption.

Britain and the west have spent decades ordering poor countries and failed states to sort out their problems with dodgy money, even while taking much of that dodgy money and ploughing it through their banks, their ritzy stores, their estate agents, and their offshore tax havens – with barely any questions asked or eyebrows raised. When Mr Cameron was caught on camera on Tuesday boasting to the Queen of the “fantastically corrupt countries” turning up at Lancaster House this week, he might have mentioned that Afghanistan is a failed state that did not get any less failed over 13 years of British intervention. And he should certainly have mentioned that the president of Nigeria, Muhammadu Buhari, is coming to London to lobby it to sort out the tax havens in its own backyard. A third of all the trillions hiding offshore are sitting in tax havens linked to the UK, according to Oxfam.

For the whole of this editorial:-

http://www.theguardian.com/commentisfree/2016/may/10/the-guardian-view-on-corruption-david-cameron-should-look-closer-to-home

There are times when a manual earth-restructuring implement is best referred to as a spade, so let us speak plainly. A summit on corruption will be held on Thursday in a city that is internationally recognised (by the IMF, among others) as a tax haven. It is being hosted by a politician who admitted last month that he has personally profited from offshore finance and whose party is bankrolled by an industry that makes extravagant use of those same tax havens. Not only that, he has intervened to aid tax avoiders. That’s right, David Cameron is holding a meeting on corruption.

Britain and the west have spent decades ordering poor countries and failed states to sort out their problems with dodgy money, even while taking much of that dodgy money and ploughing it through their banks, their ritzy stores, their estate agents, and their offshore tax havens – with barely any questions asked or eyebrows raised. When Mr Cameron was caught on camera on Tuesday boasting to the Queen of the “fantastically corrupt countries” turning up at Lancaster House this week, he might have mentioned that Afghanistan is a failed state that did not get any less failed over 13 years of British intervention. And he should certainly have mentioned that the president of Nigeria, Muhammadu Buhari, is coming to London to lobby it to sort out the tax havens in its own backyard. A third of all the trillions hiding offshore are sitting in tax havens linked to the UK, according to Oxfam.

For the whole of this editorial:-

http://www.theguardian.com/commentisfree/2016/may/10/the-guardian-view-on-corruption-david-cameron-should-look-closer-to-home

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Curbing tax-dodgers is among the EU’s great strengths – why won’t the Tories back it?

From a blog by Anneliese Dodds MEP:-

"Tackling tax dodging is one of the most cut-and-dry examples of a problem we can only fix by working together with our EU partners. Like climate change, pollution and terrorism, tax dodging is a 21st century challenge that doesn’t respect national borders. In fact, it thrives when countries don’t work together – because in that space lie the loopholes and ambiguities of which tax avoiders love to take advantage.

The EU has proposed bold and ambitious reforms to tackle tax evasion and aggressive tax avoidance – from stopping national governments cooking up sweetheart deals for particular companies, to drawing up a blacklist of tax havens and sanctioning the companies who use them, to making large multinational companies publish exactly where they make their profits and where they pay their taxes.

On the face of it, that should include David Cameron. He’s committed to staying in the EU. And he says, time and time again, that he wants to fight against tax evasion and avoidance. Unfortunately, as we’ve come to expect by now, with this PM talk is cheap. While he makes all the right noises back in the UK, his MEPs in Brussels vote against the most ambitious proposals again and again.

All of this leads me to two clear conclusions. If you want to tackle international tax avoidance once and for all, then the UK needs to be remain in the EU. And if you believe that the UK should be leading that fight in Europe, then you need a Labour government back home and not the current hypocritical Tory shambles."

http://www.anneliesedoddsmep.uk/curbing_tax_dodgers_is_among_the_eu_s_great_strengths_why_won_t_the_tories_back_it

From a blog by Anneliese Dodds MEP:-

"Tackling tax dodging is one of the most cut-and-dry examples of a problem we can only fix by working together with our EU partners. Like climate change, pollution and terrorism, tax dodging is a 21st century challenge that doesn’t respect national borders. In fact, it thrives when countries don’t work together – because in that space lie the loopholes and ambiguities of which tax avoiders love to take advantage.

The EU has proposed bold and ambitious reforms to tackle tax evasion and aggressive tax avoidance – from stopping national governments cooking up sweetheart deals for particular companies, to drawing up a blacklist of tax havens and sanctioning the companies who use them, to making large multinational companies publish exactly where they make their profits and where they pay their taxes.

On the face of it, that should include David Cameron. He’s committed to staying in the EU. And he says, time and time again, that he wants to fight against tax evasion and avoidance. Unfortunately, as we’ve come to expect by now, with this PM talk is cheap. While he makes all the right noises back in the UK, his MEPs in Brussels vote against the most ambitious proposals again and again.

All of this leads me to two clear conclusions. If you want to tackle international tax avoidance once and for all, then the UK needs to be remain in the EU. And if you believe that the UK should be leading that fight in Europe, then you need a Labour government back home and not the current hypocritical Tory shambles."

http://www.anneliesedoddsmep.uk/curbing_tax_dodgers_is_among_the_eu_s_great_strengths_why_won_t_the_tories_back_it

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Tory supporters and tax-avoidance belong in the same type of sentence as turkeys and Christmas.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

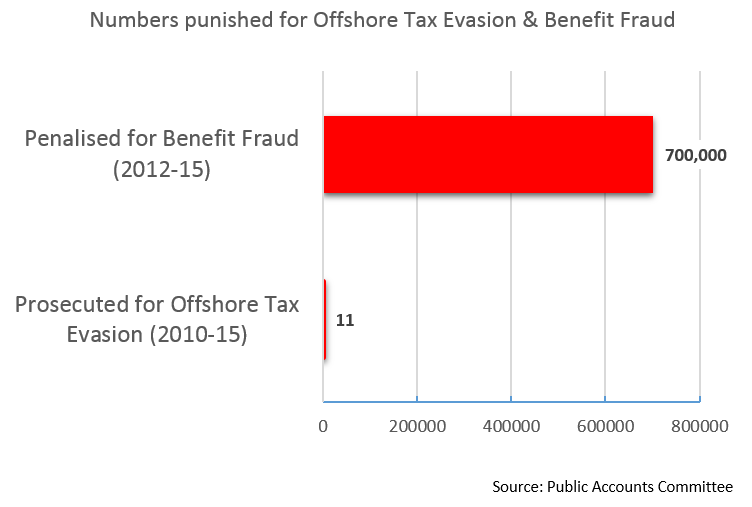

That statistic is very telling - as a country we appear to have lost our way

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

UK minimum wage law 'should cover more self-employed workers'

In the past, HMRC applied draconian rule "tests" to the description "self-employed" but under the present administration seems less concerned about potential loss of revenue through Employers pretending that their staff were self-employed.

This new proposal makes a lot of sense, as it would force Employers to pay a minimum wage and of course anything due under the PAYE system for tax and National Insurance. Allegations of unfair competition are thus avoided.

http://www.msn.com/en-gb/money/personalfinance/uk-minimum-wage-law-should-cover-more-self-employed-workers/ar-BBDJGH3?li=AA54rU&ocid=iehp

In the past, HMRC applied draconian rule "tests" to the description "self-employed" but under the present administration seems less concerned about potential loss of revenue through Employers pretending that their staff were self-employed.

This new proposal makes a lot of sense, as it would force Employers to pay a minimum wage and of course anything due under the PAYE system for tax and National Insurance. Allegations of unfair competition are thus avoided.

http://www.msn.com/en-gb/money/personalfinance/uk-minimum-wage-law-should-cover-more-self-employed-workers/ar-BBDJGH3?li=AA54rU&ocid=iehp

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

that does seem a good idea - can't see it garnering any enthusiasm in the current climate - one for the next Labour government perhaps ?

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

If "the current climate" doesn't kill everyone off first.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

That's a distinct possibility.

A friend moved to Spain several years ago - where she enjoys a very happy life in the sun as a comparatively wealthy woman - I often look wistfully at overseas property adverts. At the moment I can't see anything good about England - only staying here because my mum needs family support

A friend moved to Spain several years ago - where she enjoys a very happy life in the sun as a comparatively wealthy woman - I often look wistfully at overseas property adverts. At the moment I can't see anything good about England - only staying here because my mum needs family support

boatlady- Former Moderator

- Posts : 3832

Join date : 2012-08-24

Location : Norfolk

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

IMF: higher taxes for rich will cut inequality without hitting growth

http://www.msn.com/en-gb/money/news/imf-higher-taxes-for-rich-will-cut-inequality-without-hitting-growth/ar-AAtigTk?li=AA54rU&ocid=mailsignout

That should go down well with the Tory party and its wealthy donors.

http://www.msn.com/en-gb/money/news/imf-higher-taxes-for-rich-will-cut-inequality-without-hitting-growth/ar-AAtigTk?li=AA54rU&ocid=mailsignout

That should go down well with the Tory party and its wealthy donors.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

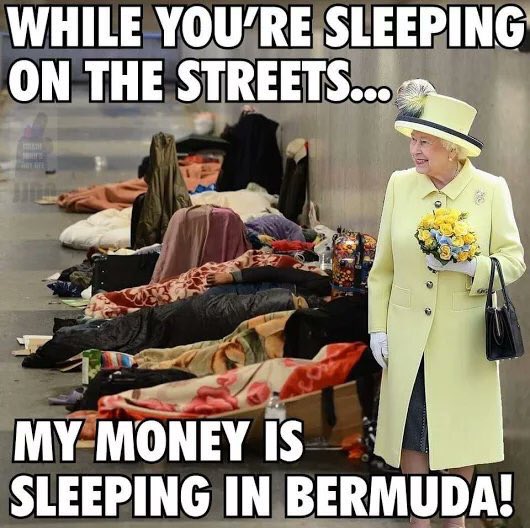

What Is The Massive Document Leak Known As The Paradise Papers?

What Is The Massive Document Leak Known As The Paradise Papers?

http://www.msn.com/en-gb/news/world/what-is-the-massive-document-leak-known-as-the-paradise-papers/ar-AAuu63c?li=BBoPU0R&ocid=iehp

Astonishing to learn that one of the richest women in the world has advisors who make investments on her behalf. Less surprising is to find said advisors following the basic rule, which is "Don't put all your eggs in one basket". Spreading the risk means sometimes making curious choices, though it's rather unlikely that Mrs Queen would invest in things like tobacco or armaments. (Governments may disagree on such matters).

The funny (not comical) thing about Offshore Tax Havens is that many of them were created specifically by HM government in former colonies after WW2 so that they could enjoy a source of income that was not dependent on the UK taxpayer.

The Law of Unintended Consequences applies.

Astonishing to learn that one of the richest women in the world has advisors who make investments on her behalf. Less surprising is to find said advisors following the basic rule, which is "Don't put all your eggs in one basket". Spreading the risk means sometimes making curious choices, though it's rather unlikely that Mrs Queen would invest in things like tobacco or armaments. (Governments may disagree on such matters).

The funny (not comical) thing about Offshore Tax Havens is that many of them were created specifically by HM government in former colonies after WW2 so that they could enjoy a source of income that was not dependent on the UK taxpayer.

The Law of Unintended Consequences applies.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

Astonishing that while the media rightly castigates Apple, 'Mrs Brown's Boys', Bono and Lewis Hamilton as "tax-dodging parasites", Mrs Windsor is somehow absolved of all responsibility for her investments. Isn't it likely that these other people have advisers who make investments on their behalf too, but isn't it also ultimately your responsibility as to what is done with your money?Astonishing to learn that one of the richest women in the world has advisors who make investments on her behalf.

Despite all the fine words from the Tories, John McDonnell argues that they will never deal with this tax scandal:-

What the 13.4m documents that comprise the 'Paradise Papers' show, like the 'Panama Papers' before them, is the sheer extent of offshore tax avoidance. The problem is endemic to the global financial system, and Britain is at the centre of it; more than £1 in every £7 that corporations place in tax havens comes through the UK. Our historical connections to notorious tax havens such as Bermuda and the Channel Islands, along with the City of London’s massive financial infrastructure, make Britain an ideal sluice for finances seeking secrecy and dodging taxes.

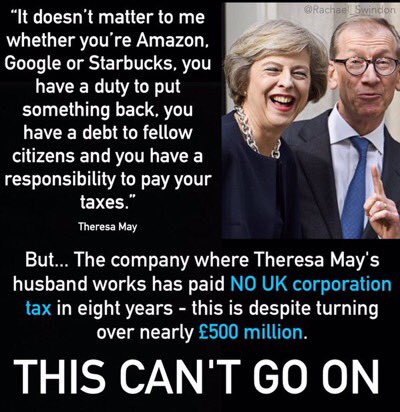

Cameron called tax avoidance “morally wrong”. Osborne called tax avoiders “leeches on society”. May said companies have a “duty” and “responsibility” to pay their taxes. Despite promises made by Cameron as far back as 2013 – and despite her rhetoric upon becoming PM – Theresa May is today pointedly refusing to back a full, public register of offshore companies and trusts. The European Parliament has directly criticised this government for obstructing the fight against money-laundering, tax evasion and tax avoidance, with Tory MEPs repeatedly seeking to block anti-avoidance measures. Osborne’s changes to the “controlled foreign company” regime – allowing multinationals a further tax loophole through which to funnel funds – has been placed under investigation by the European Commission.

HMRC has been woefully under-resourced by this government, losing 40% of its staff. It set up a specialist unit to investigate “high net worth individuals” in 2009, but when the House of Commons public accounts committee examined the unit earlier this year, they discovered it was bringing in £1bn less than when it was set up. Of the 72 investigations into wealthy individuals opened by HMRC in the five years to 2016, only one resulted in a prosecution.

https://www.theguardian.com/commentisfree/2017/nov/06/tories-tax-scandal-tory-paradise-papers-labour

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

There will always be one Law for "them" and different law for the rest of us.

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Re: Tax avoidance....the great rot?

Re: Tax avoidance....the great rot?

There is a widening gap between what the Tory administration SAYS about cracking down on Tax-evaders - and what it is actually doing.

How long must it take before even their supine voters notice?

How long must it take before even their supine voters notice?

oftenwrong- Sage

- Posts : 12062

Join date : 2011-10-08

Page 2 of 2 •  1, 2

1, 2

Similar topics

Similar topics» I'm a BriSCA F1 fan; great sport with a great history

» The commercialisation of Christmas

» Death of relatives

» What now for Labour? (Part 2)

» Tony Blair: a great Labour man and PM

» The commercialisation of Christmas

» Death of relatives

» What now for Labour? (Part 2)

» Tony Blair: a great Labour man and PM

:: The Heavy Stuff :: UK Economics

Page 2 of 2

Permissions in this forum:

You cannot reply to topics in this forum